There has been much discussion in the press of the paper released by the National Commission of Audit. Below are Shane Oliver’s, Head of Investment Strategy and Economist – AMP Capital, comments on this area:

The Government’s thorough and wide ranging National Commission of Audit highlights the basic problems facing the Federal Government’s fiscal outlook. The bottom line is that Australia’s fiscal finances should be in much better shape than they are given the boom over the last decade, the budget outlook is unsustainable and the problem is structural and reflects excessive long term growth in spending particularly from 2017-18 as the impact of the aging population will start to drive up spending in areas like health, pensions and aged care and that relying on stronger economic growth won’t solve the problem.

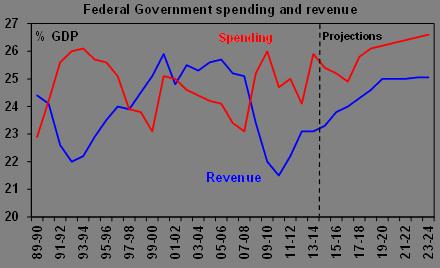

Essentially, while on unchanged policies the Commission projects that the underlying budget deficit will fall from around 3% of GDP this financial year to around 1% of GDP by 2016-17, thereafter it will rise again and remain at around 1.5% of GDP in ten years’ time. See the first chart below. This reflects an assumption that once revenue reaches around 25% of GDP, the impact of bracket creep will be returned to tax payers, but that growth in government spending will continue to trend higher largely in response to the aging population. See the second chart below.

Source: Australian Government, National Commission of Audit, AMP Capital

Source: Australian Government, National Commission of Audit, AMP Capital

The basic problem is that even if revenue rises to a capped 25% of GDP by 2024, which is 1 percentage point above its average over the 25 years to 2013-14, the budget will still be in deficit because spending is projected to have increased to 26.6% of GDP, which will be its highest ever. And still rising.

To address the projected blow out in spending and ensure a return to surplus by 2020, the Commission recommends a combination of measures including:

- Tougher means testing for the pension including the value of the family home above $500,000 for a single, slowing the indexation of the pension and increasing the retirement age from 2033;

- Co-payments for Medicare services;

- Abolishing Family Tax Benefit Part B;

- Limiting industry assistance;

- Reducing the number of government bodies; and

- More privatisation.

Some of these are likely to acted upon in the upcoming Budget. One can debate some of the measures – eg, I am not a great fan of including the family home in pensions means tests.

But given that the basic problem is a structural blow out in government spending, and the need to ensure that government aged care, pensions and health related services remain strong for those who need them, the focus has to be on measures to rein in spending growth over the longer term.

However, as the basic budget problem relates to excessive growth in spending and that it is structural, the issue then becomes why are tax hikes now apparently on the table. The much talked about tax hikes have numerous problems if implemented:

- First, the associated broken promise debate would be bad for confidence in Government (as it was for the previous government) and bad for confidence generally.

- Second, and more importantly, whether the tax hikes kick in at $80,000 (which is average earnings these days) or $100,000 it will hit middle income families and hence spending at a time when we desperately need household spending to rise to help fill the gap left by the mining boom. While the RBA could potentially help out with more interest rate cuts this is a very risky strategy as it would add to the risk that we end up with a full blown housing bubble. And it’s not clear that the RBA would play ball anyway.

- Third, the talked about 2% hike in the top marginal tax rate would take it to 49% once the Medicare and National Disability levies are allowed for. This will be the highest level since 1990 and would only reduce incentive to work more and participate in the labour force. This would contradict a key lesson of the supply side revolution of the 1980s that told us that raising marginal tax rates is not good for productivity. We already have the highest top marginal tax rate amongst our major neighbours and taking it to 49% – even if only for four years – will make the situation even worse. For example in Kong Kong the top marginal tax rate is 15%, in Indonesia its 30%, Singapore 20%, Korea 42%, Malaysia 26% and in New Zealand its 33%. Not great if we wish to retain our best and brightest.

- Finally, if the budget problem is excessive growth in spending that will really become apparent in four years’ time, then a “temporary” tax hike is not the best way to address this.

If Australia’s budget and public debt problems were on the same scale as those seen in recent years in the US and parts of Europe (where budget deficits hit 10% of GDP and public debt pushed up to around 100% of GDP) then an argument could be made for more drastic immediate action, but that is far from the case. Right now the key is to put policies in place to bring long term spending growth under control so a return to surplus is assured, without damaging the economy in the near term which could actually have the effect of making the deficit reduction task even more onerous.

Hopefully all the tax hike talk is just pre Budget kite flying.